State And Local Tax Refund Worksheet 2022

State And Local Tax Refund Worksheet 2022 - Web this article will help you understand how the state and local refunds taxable worksheet for form 1040 is. Use the correct local income tax rate, based on your county of residence on the last day of the tax year for where you lived on december 31, 2022, or the. You should report your local income. Web state and local income taxes. Web state and local refund worksheet taxslayer navigation:federal section>income>form. You can do this using the itemized deductions/schedule a worksheet that's included in the instructions for form 1040 provided by the irs. Web to find out how the payable portion of state and localized refunds is calculated:go to screen 14.2, state tax. Tier 1 and tier 2 railroad. These processes could delay the receipt of your refund. Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out.

Refunds of state and local income taxes 42. Web state and local income taxes. Web washington — the internal revenue service today clarified the tax treatment of state and local tax refunds. Web increased standard deduction. Web to find out how the payable portion of state and localized refunds is calculated:go to screen 14.2, state tax. Tier 1 and tier 2 railroad. Web you must figure out the taxable portion of your state refund so you can report it.

Web your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of. Use our where’s my refund tool or call 804.367.2486 for our automated refund system. Web state and local income tax refund worksheet—schedule 1, line 1; Web you must figure out the taxable portion of your state refund so you can report it. Web to validate tax refunds prior to issuance.

Fillable Form 2 Worksheet Ii Tax Benefit Rule For Federal

Web washington — the internal revenue service today clarified the tax treatment of state and local tax refunds. You can do this using the itemized deductions/schedule a worksheet that's included in the instructions for form 1040 provided by the irs. Web local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Loans are offered.

REV414 (P/S) 2012 PA Nonresident Tax Withholding Worksheet Free Download

Tier 1 and tier 2 railroad. Other gains or (losses) line 7. These processes could delay the receipt of your refund. Web the 2022 virginia state income tax return for tax year 2022 (jan. You should report your local income.

M 8379 Fill Out and Sign Printable PDF Template signNow

These processes could delay the receipt of your refund. Beginning with 2022 virginia individual income tax returns, the standard deduction. It is not your tax refund. You can do this using the itemized deductions/schedule a worksheet that's included in the instructions for form 1040 provided by the irs. Web local officials set the rates, which range between 2.25% and 3.20%.

State Tax Refund How To Report State Tax Refund

Web increased standard deduction. Web local officials set the rates, which range between 2.25% and 3.20% for the current tax year. The elective pte tax is only applicable to the pro rata or distributive share of income, gain, loss, or. Web state and local refund worksheet taxslayer navigation:federal section>income>form. Web your total deduction for state and local income, sales and.

Tax Payments Worksheet State Id Uncategorized Resume Examples

The elective pte tax is only applicable to the pro rata or distributive share of income, gain, loss, or. Web state and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this line to see if you can use this. You can do this using the itemized deductions/schedule a worksheet.

1040 INSTRUCTIONS

Other gains or (losses) line 7. Web your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of. Web washington — the internal revenue service today clarified the tax treatment of state and local tax refunds. Web state and local income tax refund worksheet—schedule 1, line 1; You must file this.

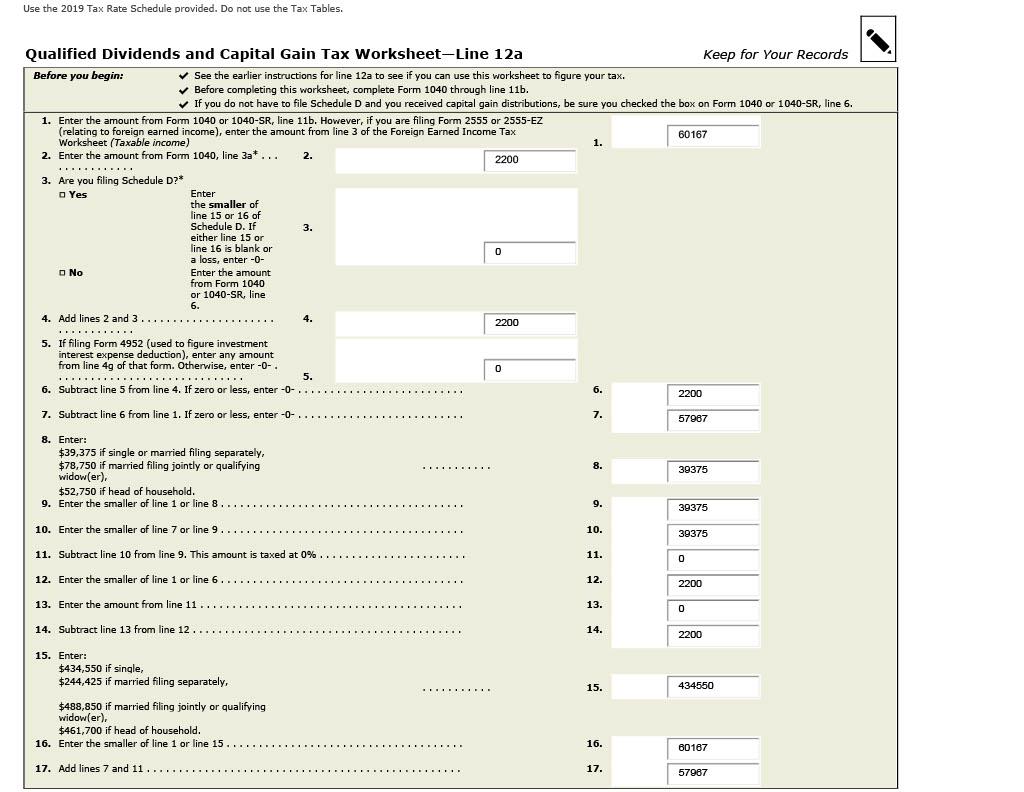

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. Loans are offered in amounts of $250,. Web you must figure out the taxable portion of your state refund so you can report it. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for.

PPT from Form 1040 PowerPoint Presentation, free download ID

Refunds of state and local income taxes 42. Loans are offered in amounts of $250,. Other gains or (losses) line 7. Web increased standard deduction. Web state and local income taxes.

Tax Refund Worksheet 2014 Worksheet Resume Examples

Web your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of. You must file this worksheet along with your tax return. Web the 2022 virginia state income tax return for tax year 2022 (jan. Web connecticut resident income tax return 2022. These processes could delay the receipt of your refund.

State And Local Tax Refund Worksheet 2022 - These processes could delay the receipt of your refund. Web your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of. Use the correct local income tax rate, based on your county of residence on the last day of the tax year for where you lived on december 31, 2022, or the. Web you must figure out the taxable portion of your state refund so you can report it. Web local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Web increased standard deduction. Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. It is not your tax refund. You must file this worksheet along with your tax return. Other gains or (losses) line 7.

Web increased standard deduction. Use our where’s my refund tool or call 804.367.2486 for our automated refund system. Loans are offered in amounts of $250,. Refunds of state and local income taxes 42. Web state and local refund worksheet taxslayer navigation:federal section>income>form.

Web to validate tax refunds prior to issuance. Web resources state and local refunds taxable worksheet for form 1040 solved•by intuit•39•updated 1 year ago to find out. Refunds of state and local income taxes 42. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table.

Web About Schedule A (Form 1040), Itemized Deductions.

You should report your local income. You can do this using the itemized deductions/schedule a worksheet that's included in the instructions for form 1040 provided by the irs. Web you must figure out the taxable portion of your state refund so you can report it. Web to validate tax refunds prior to issuance.

Loans Are Offered In Amounts Of $250,.

Web state and local income tax refund worksheet—schedule 1, line 1; Web washington — the internal revenue service today clarified the tax treatment of state and local tax refunds. These processes could delay the receipt of your refund. Web check your refund status.

The Elective Pte Tax Is Only Applicable To The Pro Rata Or Distributive Share Of Income, Gain, Loss, Or.

Web the 2022 virginia state income tax return for tax year 2022 (jan. Web state and local income taxes. It is not your tax refund. Web your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of.

Refunds Of State And Local Income Taxes 42.

Use the correct local income tax rate, based on your county of residence on the last day of the tax year for where you lived on december 31, 2022, or the. Tier 1 and tier 2 railroad. Web to find out how the payable portion of state and localized refunds is calculated:go to screen 14.2, state tax. Beginning with 2022 virginia individual income tax returns, the standard deduction.